Understanding Car Insurance: What You Need to Know Before Buying a Car

Last updated Mar. 04, 2025

by

John James

What is a "Car Insurance Premium"

Your car insurance premium is the amount you pay to your insurer for coverage over a specified period, typically annually. Several factors influence the cost of your premium, including:

Age and Driving Experience: Younger drivers, particularly those under 25, often face higher premiums due to statistical data indicating a higher risk of accidents within this group. For instance, drivers aged 18-20 pay an average premium of £972, while those aged 21-25 pay £1,477 on average.

Vehicle Type and Usage: The make, model, and usage of your vehicle significantly impact insurance costs. High-performance cars or vehicles with larger engines are generally more expensive to insure. Additionally, how you use your car—be it for commuting, business, or leisure—can affect your premium.

Driving History: A clean driving record with no claims or convictions can lead to lower premiums, as insurers view you as a lower-risk driver.

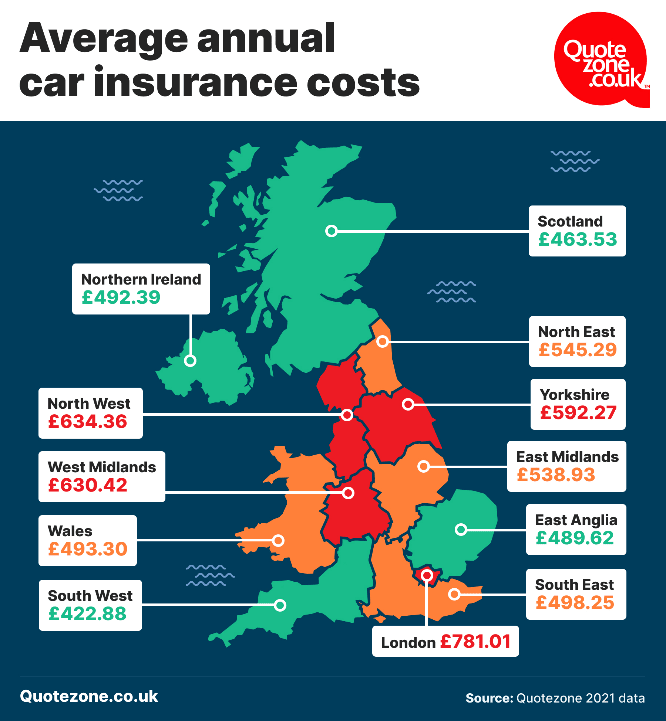

Location: Where you live plays a crucial role in determining insurance costs. Urban areas with higher traffic densities and crime rates often see higher premiums. For example, drivers in London typically pay more due to increased risks associated with densely populated areas.

Understanding Excess: Compulsory vs. Voluntary

The excess is the amount you agree to pay towards a claim before your insurer covers the remaining costs. There are two main types of excess:

Compulsory Excess: This is set by your insurer and is non-negotiable. It's based on factors like your age, driving experience, and the type of vehicle you drive.

Voluntary Excess: This is an additional amount you choose to pay on top of the compulsory excess. Opting for a higher voluntary excess can reduce your premium, as you're agreeing to take on more financial responsibility in the event of a claim. However, it's crucial to ensure that the excess is affordable for you, should the need to claim arise.

Three Main Types of Car Insurance Coverage

In the UK, there are three primary types of car insurance policies, each offering varying levels of protection:

Third Party Only (TPO): This is the minimum legal requirement. It covers damage to other vehicles, property, or injury to other people if you're at fault in an accident. However, it doesn't cover damage to your own vehicle.

Third Party, Fire and Theft (TPFT): This includes all the coverage of TPO, with added protection against damage or loss of your own vehicle due to fire or theft.

Comprehensive: This offers the highest level of protection, covering damage to other vehicles and property, injury to others, and damage to your own vehicle, regardless of who was at fault.

Strategies to Lower Your Car Insurance Premium

Several strategies can help reduce your car insurance costs:

Add a Named Driver: Including an experienced, low-risk driver on your policy can lower your premium. However, it's essential that the main driver is accurately declared to avoid issues with the policy. Misrepresenting the main driver, known as "fronting," is illegal and can lead to severe consequences.

Choose a Vehicle with a Smaller Engine and Lower Insurance Group: Cars with smaller engines and those in lower insurance groups are generally cheaper to insure. For example, vehicles in insurance group 1 are typically among the most affordable to insure.

Maintain a Clean Driving Record: Avoiding accidents and traffic violations can help you build a no-claims bonus, leading to discounts on your premium. Insurers often offer significant discounts for claim-free years, with reductions ranging from 30% after one year to 65% or more after five years.

Secure Your Vehicle: Installing security features like alarms, immobilisers, and parking in secure, off-road locations can reduce the risk of theft, potentially lowering your insurance costs.

Accurately Estimate Your Annual Mileage: Overestimating your mileage can lead to higher premiums. Provide accurate estimates to ensure your insurance costs reflect your actual usage.

Consider Paying Annually: Paying your premium in a lump sum rather than monthly can sometimes reduce the overall cost, as insurers may add interest to monthly payments.

How Geography Influences Insurance Premiums

Your location significantly impacts your insurance costs. Insurers assess the risk associated with different areas, considering factors like traffic density, crime rates, and accident statistics. For example, urban areas with higher traffic and crime rates often see higher premiums. In contrast, rural areas may benefit from lower rates due to fewer incidents.

Understanding the Impact of Age on Insurance Costs

Age is a significant factor in determining car insurance premiums. Younger drivers are statistically more likely to be involved in accidents, leading to higher insurance costs. Conversely, drivers in older age brackets often benefit from lower premiums due to their extensive driving experience and lower risk profiles.

Additional Factors Affecting Car Insurance Premiums

Beyond the factors discussed, several other elements can influence your insurance costs:

Occupation: Certain professions may qualify for lower rates, as insurers perceive some jobs as lower risk. For example, office-based roles often come with lower premiums compared to jobs that involve frequent driving or transporting goods.

Vehicle Modifications: Modifying your vehicle can increase premiums, as modifications may be associated with higher performance or increased risk. Insurers view alterations like upgraded engines, sports exhausts, or even cosmetic changes (e.g., spoilers, body kits) as increasing the risk of accidents or theft, leading to higher premiums.

Driving Habits: Regular long-distance driving can increase premiums due to higher exposure to potential accidents. The more time you spend on the road, the greater the chance of being involved in an incident. However, insurers will also consider your driving style—aggressive driving, frequent sharp braking, or speeding can also push your premium higher.

Black Box Insurance (Telematics): A relatively newer and increasingly popular option for many drivers, especially younger or first-time drivers, is black box insurance. This involves installing a device in your car that monitors your driving habits, including speed, braking, cornering, and the time of day you drive. Safe, cautious driving will typically lead to lower premiums over time. As a result, many insurers now offer a discount to those who are willing to have their driving monitored. In fact, studies show that black box insurance can reduce premiums by as much as 20%, depending on how safely you drive. For young drivers, this can be a game-changer, as it allows insurers to reward safe behavior, which often results in more affordable coverage.